Contents

hide

Eye care can become expensive quickly. The costs of frames, lenses, exams, coatings, and contacts add up, especially if you have children, experience digital eye strain, or manage medical conditions such as dry eye or diabetes.

That’s where vision insurance comes in.

Vision insurance can help lower your overall eye care expenses.

Vision insurance can help lower your overall eye care expenses.

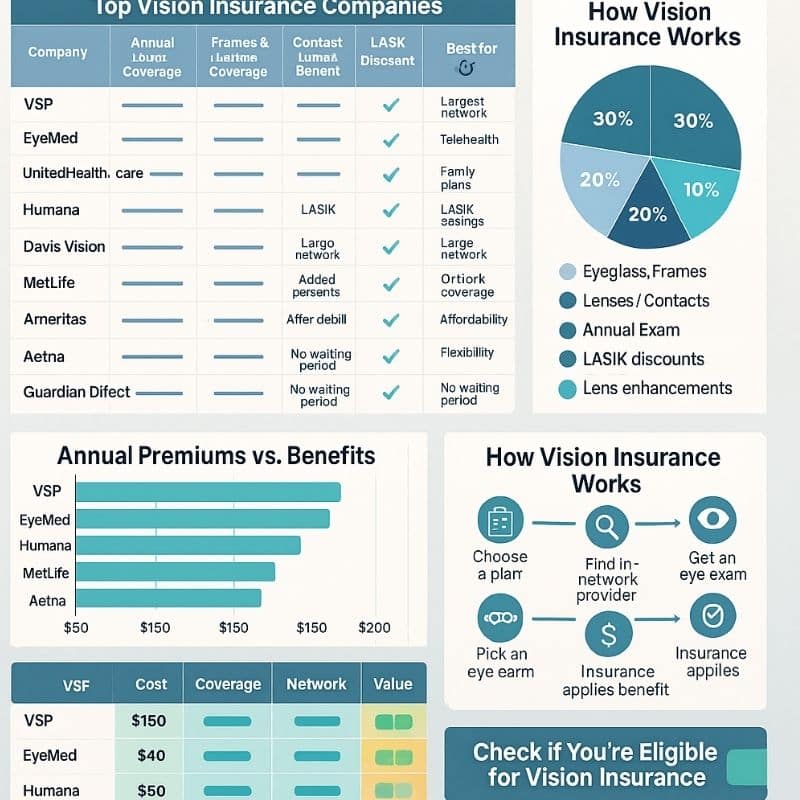

With many companies offering vision insurance, it can be difficult to determine which plans provide the most value, since some are stronger for families (like MetLife or VSP), others serve contact lens users better (such as UnitedHealthcare or Aetna Vision), and some offer the greatest retail shopping options (like EyeMed).

To help you choose, we reviewed plan benefits, consulted with eye care providers, read member reviews, and compared provider networks. This guide to the 10 best vision insurance companies is based on both medical expertise and consumer feedback.

Before diving into the details, here’s a quick visual comparison of the Top 10 Vision Insurance Companies for 2025.

1. VSP Vision Care

Best for: People who want a dependable, no-surprise plan

Many optometrists report that most of their patients use VSP. VSP is considered a reliable choice and is known for consistent performance.

Here’s why patients like it:

- The network is huge. You can usually keep your current eye doctor.

- Benefits are simple. No decoding needed.

- Frame allowances are consistently generous.

- Lens enhancements (anti-reflective, blue-light filters, thinner lenses) are discounted more than average.

VSP is designed for people who prefer a straightforward process. You schedule your exam, select your glasses, pay the copay, and complete your visit.

For those who value reliability and simplicity, VSP is a strong option.

2. EyeMed

Best for: Shoppers who love options, especially at big retail chains

EyeMed is commonly found at retailers such as LensCrafters and Target Optical. The plan allows flexibility, so you can have your exam at a private office, purchase glasses at a retail store, or order contacts online.

Why do people choose EyeMed?

- Wide retail access (Target Optical, LensCrafters, Pearle Vision)

- Great frame selection, especially fashion brands

- Good pricing on premium lens upgrades

- Meaningful discounts on LASIK procedures

EyeMed is a good option for those who value convenience or prefer to try on frames in person, especially compared to VSP, which is typically chosen for its straightforward process rather than retail options.

3. UnitedHealthcare Vision

Best for: People who already have UnitedHealthcare for medical insurance

UnitedHealthcare Vision is often chosen by people who already have UnitedHealthcare medical insurance, as it simplifies billing and coordination.

What stands out:

- Coverage options for both glasses and contacts

- Large provider network

- Plans tailored for contact-lens wearers

- Good integration between medical and vision care

If you are already enrolled in UnitedHealthcare, adding vision coverage can streamline your insurance management.

4. Humana Vision

Best for: Budget-conscious individuals who still want strong benefits

Humana Vision typically offers some of the lowest premiums. It provides solid coverage for individuals who want insurance at a lower cost.

People appreciate:

- Affordable monthly pricing

- Straightforward benefits

- A good network, especially in suburban areas

- Reliable exam coverage

For those new to vision insurance or seeking to manage costs, Humana Vision offers a balance between affordability and coverage.

5. Davis Vision

Best for: People who invest in high-quality lenses

Davis Vision is recognized by eye care professionals for its strong lens benefits. The plan is especially helpful for those who prioritize clarity, glare reduction, or advanced lens technology.

Members like:

- Upgraded lenses at lower prices

- Solid frame allowances

- Reputable partner labs

- Good support for families

This plan is well-suited for individuals who require progressive lenses or spend significant time using digital devices.

6. Ameritas Vision

Best for: People with unique eye care needs or specialty lenses

Ameritas Vision offers more than basic coverage. Many of its plans include optional add-ons that are not commonly available from other companies.

Examples include:

- Coverage for orthokeratology

- Support for keratoconus

- Extended benefits for high prescriptions

Ameritas is often chosen by individuals who require more comprehensive vision coverage.

7. MetLife Vision

Best for: Families and people who want consistency across the country

MetLife Vision is a widely recognized provider, and its vision plans are trusted by many families. The extensive network ensures that providers are accessible in most locations.

Members get:

- Coverage for exams, glasses, and contacts

- Access to many private clinics and retail chains

- Discounts on refractive surgery

- Easy online management

MetLife is often considered convenient for parents whose children frequently need new glasses due to breakage, loss, or changes in prescription.

8. Aetna Vision

Best for: People who want clear and easy-to-use coverage

Aetna Vision is designed for simplicity. The plan uses clear language, provides straightforward benefits, and streamlines the checkout process.

Here’s what users appreciate:

- Good balance between exam, frame, and lens benefits

- A clean digital portal

- Lens upgrades are offered at competitive rates.

- Strong national provider network

Aetna Vision is a good option for those seeking a plan that is easy to use and manage.

9. Cigna Vision

Best for: Those who want both vision and medical coordination

Cigna Vision is particularly beneficial for individuals with chronic eye conditions such as diabetes, autoimmune diseases, or thyroid disorders.

Benefits include:

- Comprehensive eye exams

- Competitive allowances for frames/lenses

- LASIK discounts

- Coordinated medical and vision benefits

Cigna Vision is a suitable option for those who require both routine vision care and occasional medical eye care.

10. Guardian Direct Vision

Best for: Freelancers, gig workers, and people who do not have employer plans

Guardian Direct Vision is a strong option for individuals purchasing their own coverage. Enrollment is simple, pricing is competitive, and benefits are clearly defined.

Members get:

- Coverage for exams, frames, and lenses

- Access to many top eye-care providers

- Low entry-level premiums

- Good customer service for individual buyers

For those who are self-employed or between jobs, Guardian Direct is often the most budget-friendly option while still providing adequate coverage.

How to Choose the Right Vision Insurance Company

Selecting the right vision insurance plan depends on your individual needs, how frequently you purchase glasses, your preferred shopping locations, and the complexity of your prescription.

Here are questions eye doctors want patients to ask themselves:

1. Do I replace my glasses every year?

If yes, choose a plan with a strong frame allowance (VSP, EyeMed, Davis Vision).

If yes, choose a plan with a strong frame allowance (VSP, EyeMed, Davis Vision).

2. Do I prefer a private practice or retail optical?

If you prefer private practices, choose VSP.

If you like shopping at retail stores, choose EyeMed.

If you prefer private practices, choose VSP.

If you like shopping at retail stores, choose EyeMed.

3. Do I have a high or complex prescription?

Ameritas or Davis Vision often saves the most money.

Ameritas or Davis Vision often saves the most money.

4. Do I wear contacts more than glasses?

UnitedHealthcare Vision or Aetna Vision has plans designed for you.

5. Am I buying insurance for a whole family?

MetLife or VSP tends to be the easiest.

MetLife or VSP tends to be the easiest.

Which Vision Insurance Company Should You Choose?

There is no single plan that is best for everyone. The most appropriate choice is the one that matches your specific needs.

Based on available data and patient experiences:

- VSP Vision Care is the most reliable all-around choice.

- EyeMed is unbeatable for retail shoppers.

- Davis Vision is the best for lens upgrades and tech-heavy prescriptions.

- Ameritas is ideal for specialized lens needs.

- UnitedHealthcare Vision works well if you already have UHC medical coverage.

If you want the plan with the least amount of frustration?

VSP or MetLife.

If you want the plan with the most freedom?

EyeMed.

VSP or MetLife.

If you want the plan with the most freedom?

EyeMed.

Regardless of which plan you choose, it is important to keep in mind:

Good vision insurance not only helps you save money but also supports your long-term eye health.

Good vision insurance not only helps you save money but also supports your long-term eye health.